Empowering Innovators, Accelerating Growth

Visionet Ventures, led by industry veteran Arshad Masood, is a venture development company dedicated to investing in early-stage technology startups across key sectors like supply chain, mortgage, BFSI, AI, and healthcare. We go beyond traditional venture capital by actively providing the critical resources needed for success. We build the foundation, offer tech expertise, inject capital, refine business models, structure legal frameworks, and drive growth—all to ensure rapid and sustained success.

Our investment portfolio

Our portfolio includes transformative companies such as PartnerLinQ, AtClose, and DocVu, each contributing to our commitment to fueling innovation and delivering impactful results.

PartnerLinQ

PartnerLinQ, a key investment in our portfolio, has grown significantly to become a leader in supply chain connectivity. Today, the platform processes over 120 million transactions per month, supports 12,000+ trading partners, manages 65,000+ documented relationships, and offers 75+ pre-built SOR integrations. PartnerLinQ enables real-time decision-making, end-to-end visibility, and optimized performance, empowering businesses to mitigate risks, uncover new revenue streams, and drive sustainable growth in complex global supply chains.

Transactions per month

Trading partners

Documented relationships

pre-built SOR integrations

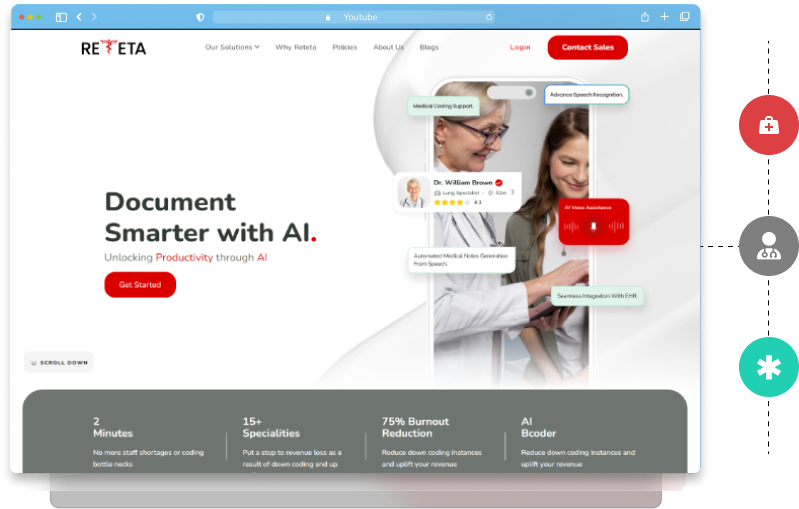

Reteta

Reteta, a major new player in our healthcare portfolio, offers cutting-edge AI applications focused on improving clinical documentation and automating key processes in healthcare. By reducing inefficiencies and providing data-driven insights, Reteta’s AI solutions enhance the accuracy of medical documentation and streamline coding. With a commitment to responsible AI, Reteta is dedicated to creating fair, transparent, and tailored solutions that address real-world challenges in healthcare and life sciences.

2

Minutes

Average SOAP Note closure time

15+

Specialities

Catering accurate SOAP Notes across specialties

75% Burnout

Reduction

Clinicians can focus on what matters

AI-Powered

Medical Coding

Accurate medical coding & reduced claim denial

Docvu.ai

DocVu.AI revolutionizes document management with advanced AI for industries like Financial Services, Insurance, and Healthcare. Today, with 700+ employees, 100+ clients, and 14 global offices, it automates workflows like mortgage processing, KYC, and invoice management. DocVu.AI’s intelligent algorithms and customizable workflows ensure efficiency, scalability, and a strong ROI, transforming how businesses handle document-driven processes.

Data elements processed

Clients

Accuracy

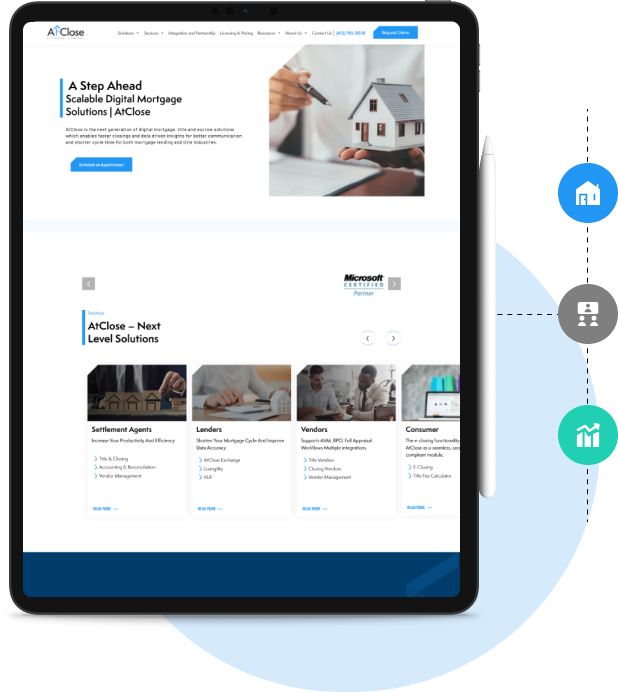

AtClose

AtClose, another key investment in our portfolio, is at the forefront of digital mortgage, title, and escrow solutions. It streamlines the closing process with data-driven insights, enhancing communication and reducing cycle times for both mortgage lending and title industries. AtClose’s scalable platform delivers next-generation capabilities, enabling faster closings and more efficient operations in today’s competitive market.